Journalize the following business transactions in general journal form – Journalizing business transactions in general journal form is a fundamental accounting practice that provides a chronological record of financial activities. This comprehensive guide will delve into the purpose, steps, and benefits of journalizing, as well as the essential elements of a general journal and best practices for accurate and reliable recording.

Define Journalizing Business Transactions

Journalizing business transactions is the process of recording financial transactions in a systematic manner. It involves analyzing and classifying transactions, and then recording them in a journal, which is a chronological record of all business activities.

The purpose of journalizing is to provide a complete and accurate record of all financial transactions, which is essential for:

- Tracking the financial activities of the business

- Preparing financial statements

- Ensuring the accuracy and completeness of financial records

General Journal Format

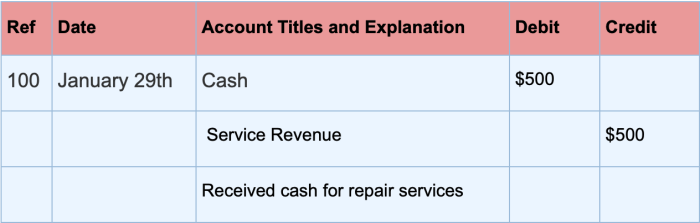

The general journal is a chronological record of all business transactions. It is typically organized into the following columns:

| Date | Account | Debit | Credit | Description |

|---|---|---|---|---|

| 2023-03-01 | Cash | $1,000 | Received cash from customer for services rendered | |

| 2023-03-05 | Supplies | $500 | Purchased office supplies on account |

The Datecolumn indicates the date of the transaction.

The Accountcolumn identifies the account that is being debited or credited.

The Debitcolumn records the amount that is being debited to the account.

The Creditcolumn records the amount that is being credited to the account.

The Descriptioncolumn provides a brief description of the transaction.

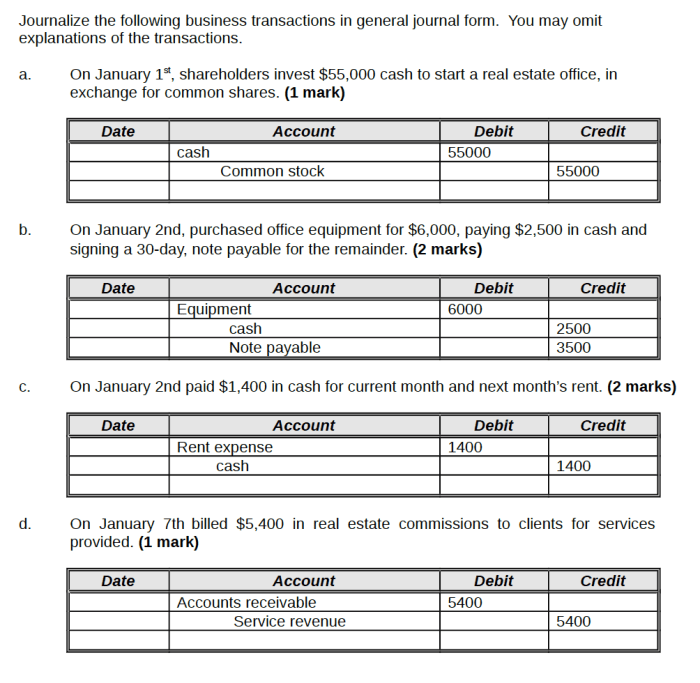

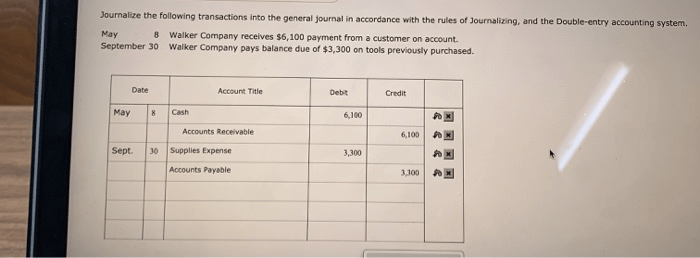

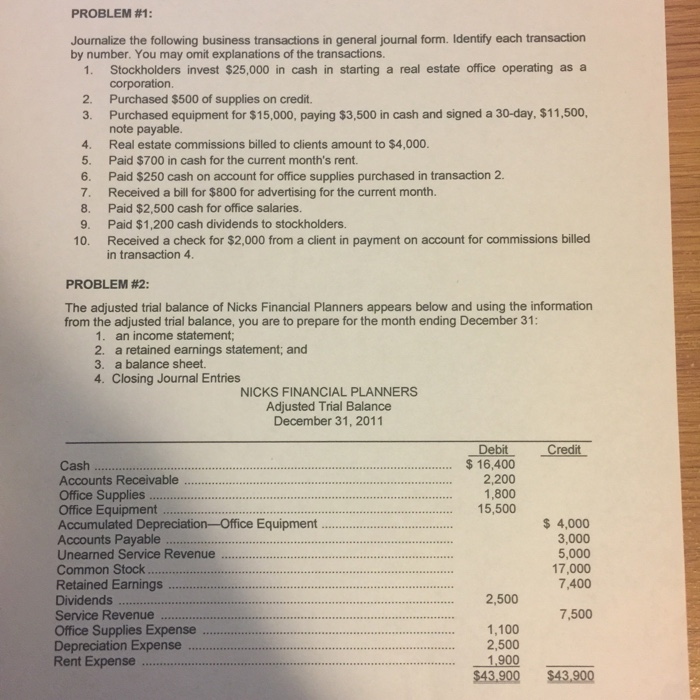

Examples of Journalizing Transactions: Journalize The Following Business Transactions In General Journal Form

The following are examples of common business transactions and their corresponding journal entries:

- Cash receipts:Debit Cash, credit Accounts Receivable

- Purchases:Debit Purchases, credit Accounts Payable

- Sales:Debit Accounts Receivable, credit Sales Revenue

- Payments:Debit Accounts Payable, credit Cash

- Adjustments:Debit or credit various accounts to adjust the balances

Posting to Accounts

After transactions have been journalized, they must be posted to the individual accounts in the ledger. Posting involves transferring the amounts from the journal to the appropriate accounts. The ledger is a collection of accounts that are used to track the balances of all assets, liabilities, equity, revenues, and expenses.

To post a transaction, the following steps are followed:

- Identify the account that is being debited.

- Enter the debit amount in the debit column of the account.

- Identify the account that is being credited.

- Enter the credit amount in the credit column of the account.

Benefits of Journalizing Transactions

Journalizing business transactions provides a number of benefits, including:

- Provides a complete and accurate record of all financial transactions.This is essential for tracking the financial activities of the business and preparing financial statements.

- Helps to prevent errors.By recording transactions in a chronological order, it is easier to identify and correct any errors that may occur.

- Facilitates the preparation of financial statements.The journal provides a summary of all transactions that have occurred during a period of time, which can be used to prepare financial statements.

Best Practices for Journalizing

To ensure the accuracy and completeness of journal entries, it is important to follow best practices, including:

- Record transactions timely.Transactions should be recorded as soon as possible after they occur.

- Use clear and concise descriptions.The description of each transaction should be clear and concise, so that it is easy to understand what occurred.

- Support transactions with documentation.Whenever possible, transactions should be supported by documentation, such as invoices, receipts, or bank statements.

- Establish internal controls.Internal controls should be established to help prevent errors and fraud.

- Review journal entries regularly.Journal entries should be reviewed regularly to ensure accuracy and completeness.

FAQ Explained

What is the purpose of journalizing business transactions?

Journalizing provides a chronological and detailed record of all financial transactions, allowing businesses to track their financial activities and maintain an accurate accounting record.

What are the key steps involved in journalizing transactions?

The steps include identifying the transaction, determining the accounts affected, and recording the transaction in the general journal, including the date, account names, debit and credit amounts, and a brief description.

Why is it important to use a consistent general journal format?

A consistent format ensures uniformity and accuracy in recording transactions, facilitating easy tracking and analysis of financial activities.