Del Gato Clinic bank reconciliation is a crucial process that ensures the accuracy and integrity of financial records. By reconciling bank statements with internal accounting records, organizations can identify and correct errors, prevent fraud, and maintain financial compliance.

This comprehensive guide provides a step-by-step overview of the bank reconciliation process at Del Gato Clinic, highlighting unique challenges and best practices. It also explores common issues that may arise during reconciliation and discusses internal controls to mitigate risks.

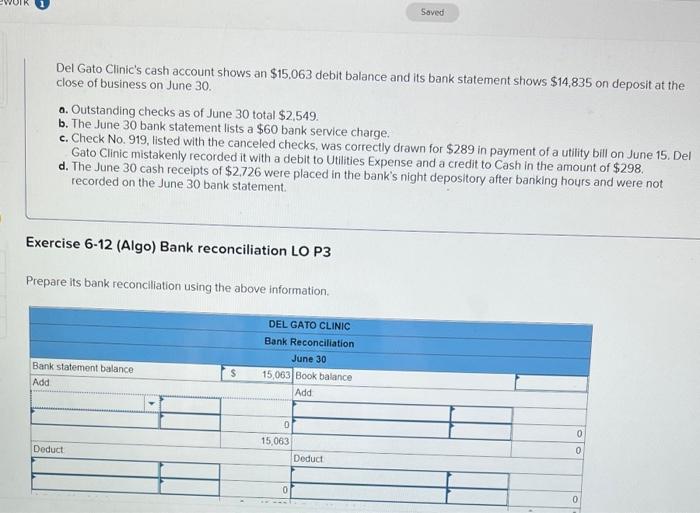

Bank Reconciliation Overview: Del Gato Clinic Bank Reconciliation

Bank reconciliation is the process of comparing an entity’s records of cash transactions with the records of its bank to ensure that both sets of records are in agreement.

Typical bank reconciliation errors include:

- Outstanding checks: Checks that have been written but not yet cashed.

- Deposits in transit: Deposits that have been made but not yet recorded by the bank.

- Bank errors: Errors made by the bank, such as incorrect deposits or withdrawals.

Del Gato Clinic Bank Reconciliation Process

The Del Gato Clinic bank reconciliation process involves the following steps:

- Gather the necessary documents, including the bank statement, the clinic’s cash receipts journal, and the clinic’s cash disbursements journal.

- Compare the bank statement to the cash receipts journal and the cash disbursements journal to identify any discrepancies.

- Investigate and resolve any discrepancies.

- Prepare a bank reconciliation statement.

Del Gato Clinic’s bank reconciliation process is unique in that it uses a spreadsheet to automate the process.

Common Bank Reconciliation Issues

Common bank reconciliation issues include:

- Outstanding checks

- Deposits in transit

- Bank errors

Outstanding checks can be identified by comparing the bank statement to the clinic’s cash disbursements journal. Deposits in transit can be identified by comparing the bank statement to the clinic’s cash receipts journal. Bank errors can be identified by comparing the bank statement to the clinic’s own records.

Best Practices for Bank Reconciliation

Best practices for effective bank reconciliation include:

- Establishing clear procedures

- Using technology to automate the process

- Regularly reviewing reconciliations

Establishing clear procedures can help to ensure that bank reconciliations are performed consistently and accurately. Using technology to automate the process can save time and reduce the risk of errors. Regularly reviewing reconciliations can help to identify any errors that may have occurred.

Internal Controls for Bank Reconciliation

Internal controls can help to prevent or detect errors in bank reconciliations. Some common internal controls for bank reconciliation include:

- Segregation of duties

- Independent review of reconciliations

- Regular monitoring of bank accounts

Segregation of duties can help to prevent fraud by ensuring that no one person has complete control over the bank reconciliation process. Independent review of reconciliations can help to identify any errors that may have been made. Regular monitoring of bank accounts can help to identify any unauthorized activity.

Using Excel for Bank Reconciliation

Microsoft Excel can be used to perform bank reconciliations. To create a bank reconciliation template in Excel, follow these steps:

- Create a new Excel workbook.

- In the first row of the workbook, enter the following column headings: Date, Description, Amount.

- In the second row, enter the date of the bank statement.

- In the third row, enter the description of the bank statement.

- In the fourth row, enter the amount of the bank statement.

- Repeat steps 3-5 for each transaction on the bank statement.

Once you have created a bank reconciliation template, you can import your bank statement into Excel. To do this, follow these steps:

- Click on the “Data” tab.

- Click on the “Get External Data” button.

- Click on the “From Text” button.

- Select the bank statement file that you want to import.

- Click on the “Import” button.

Once you have imported your bank statement into Excel, you can use formulas to identify any discrepancies between the bank statement and your records.

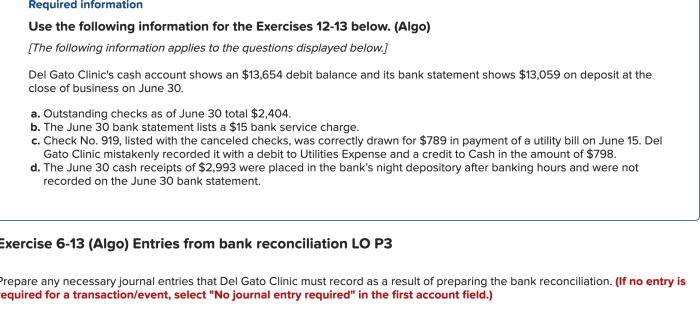

Expert Answers

What is the purpose of bank reconciliation?

Bank reconciliation ensures that the balance in an organization’s accounting records matches the balance in its bank statements, identifying and correcting any discrepancies.

What are common challenges in bank reconciliation?

Common challenges include outstanding checks, deposits in transit, and bank errors. Proper documentation and timely follow-up are crucial to address these issues effectively.

How can technology assist in bank reconciliation?

Software and online platforms can automate data entry, identify discrepancies, and generate reconciliation reports, improving efficiency and reducing the risk of errors.